- Industry news

Industry news

- Category news

Category news

- Reports

- Key trends

- Multimedia

- Journal

- Events

- Suppliers

- Home

- Industry news

Industry news

- Category news

Category news

- Reports

- Key trends

- Multimedia

- Events

- Suppliers

Artificial food colors: How brands can triumph from changing US regulations

Key takeaways

- The US FDA and Department of Health and Human Services are banning synthetic, petroleum-based food dyes, prompting a nationwide transition toward natural color alternatives.

- Major brands like Walmart, Kraft Heinz, Nestlé, Hershey, and PepsiCo are reformulating products to align with clean label standards and consumer demand for safer, simpler ingredients.

- Advances in plant-based colorants (from sources like spirulina, butterfly pea flower, and carrots) are driving new product development, offering stability, vibrancy, and sustainability benefits.

US consumers are increasingly avoiding artificial food colorings, but petroleum‑based, synthetic food dyes are still present in almost half of new food and beverage product launches in the country. This gap between consumer expectations and clean label product launches in categories including confectionery creates opportunities for brands eager to embrace natural alternatives.

New research by Innova Market Insights suggests that breakthroughs in plant-based colorants will inspire the shift toward natural colors and clean label alternatives in the US F&B market, as regulators and consumers rapidly turn against artificial colors.

New health regulations, driven by US Secretary of Health and Human Services Robert F. Kennedy Jr.’s “Make America Healthy Again” (MAHA) movement, have spurred investment in natural, clean label products and ingredient traceability.

In January 2025, the US FDA issued a final order to ban the synthetic red food dye FD&C Red No. 3 in all foods, effective January 2027. In April 2025, the FDA and the US Department of Health and Human Services launched an initiative to phase out all petroleum‑based, synthetic food dyes by the end of next year.

This year, the FDA approved four new natural colors to ease the transition toward clean label additives: galdieria extract blue (algae‑derived), butterfly pea flower extract, calcium phosphate (white pigment), and Gardenia (genipin) blue (fruit‑derived).

“Spirulina and carrot-based colors are also emerging as clean label alternatives to synthetic FD&C Blue 1 and caramel colorings, respectively,” Lu Ann Williams, global SVP Research at Innova Market Insights, tells Food Ingredients First.

“These innovations not only expand the natural color spectrum but also address concerns with pH sensitivity, shelf life, and brightness, which have been past challenges. Brands can build consumer trust by using certified organic or sustainably-grown ingredient claims.”

Innova has released its “Trending in Color Ingredients in F&B in the US” report to help brands understand what’s next in this fast-changing category.

Food & beverage leaders scrap artificial dyes

Walmart announced this month that it plans to eliminate artificial colorings and more than 30 controversial additives to promote cleaner, safer ingredients in its private brand food products, including Great Value, Marketside, and Freshness Guaranteed.

“Our customers have told us they want products made with simpler, more familiar ingredients — and we’ve listened. By eliminating synthetic dyes and other ingredients, we’re reinforcing our promise to deliver affordable food that families can feel good about,” says Walmart’s president and CEO, John Furner.

The US retail giant claims that around 90% of its private food brands are already free from synthetic dyes. The Innova Database suggests that 6.4% of Walmart’s bakery product launches and 3.6% of its snack product launches in the US between July 2024 and June 2025 used artificial colors which face regulatory phase out.

“Walmart’s decision has been hailed as ‘one of the largest’ private brand reformulations in retail history, and consumers can expect these new products to appear on shelves in the coming months,” says Williams.

Meanwhile, major F&B companies, including Kraft Heinz, Nestlé, Hershey, and PepsiCo, are rapidly reformulating products to eliminate artificial colors and dyes.

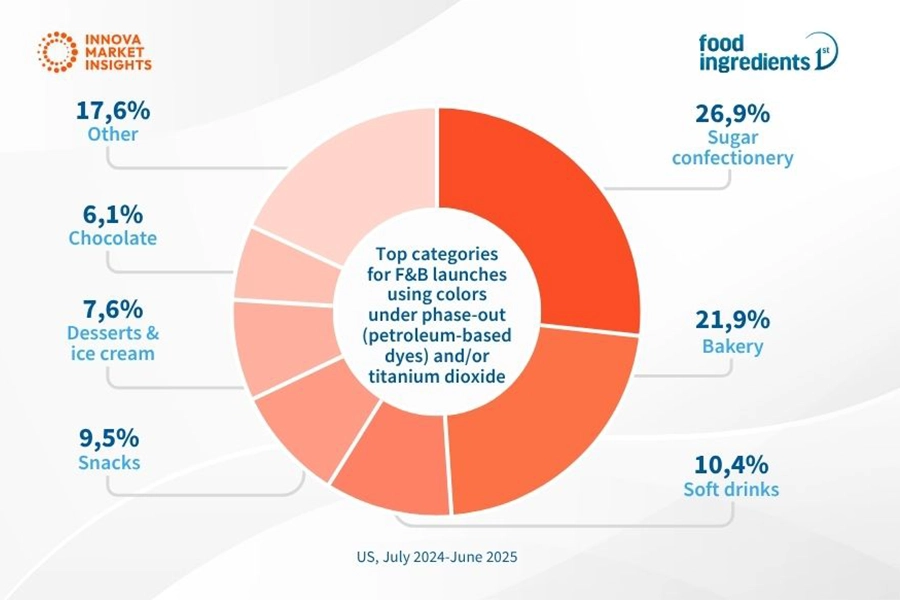

“This shift is driven by mounting regulatory pressure, health advocacy (notably from RFK Jr.), and evolving consumer interest in cleaner labels and natural ingredients. The reformulation timelines range from 2026 to 2027, signaling urgency for competitive alignment,” Williams adds. Petroleum-based dyes and titanium dioxide remain prevalent in new product launches, with sugar confectionery, bakery, and soft drinks leading the categories using synthetic colorants.

Petroleum-based dyes and titanium dioxide remain prevalent in new product launches, with sugar confectionery, bakery, and soft drinks leading the categories using synthetic colorants.

Natural solutions to complex challenges

The US color ingredients market is becoming increasingly complex. Color plays an integral role in shaping consumer perceptions and influencing their purchasing behavior, and US consumers are increasingly seeking safe and easy to understand F&B products.

However, in some categories, petroleum-based dyes and/or titanium dioxide are still common in new product launches. Sugar Confectionery is the top category, accounting for 26.9% of these launches, followed by Bakery (21.9%), and Soft Drinks (10.4%) (US, July 2024–June 2025).

“For some brands, complexity with reformulation, supply issues, and the risk of altering iconic colors present concerns. In contrast, others have used this transition as an opportunity to position themselves as brands that meet evolving consumer expectations,” says Williams.

Innova’s consumer trends research indicates that 37% of US consumers avoid artificial food colorings, additives, and preservatives, incentivizing investment in plant-based alternatives, including plant-based colorants.

California Natural Color offers a vibrant array of fruit- and vegetable-based colors optimized for pH, heat, and light stability. It recently launched Pure Brown Carrot, a clean label alternative to caramel coloring made from carrot concentrate or vegetable juice.

Sensient Food Color has developed Marine Blue Capri, a natural, bright blue solution derived from spirulina for low-pH beverages, offering a clean label alternative to synthetic FD&C Blue 1.

Meanwhile, GNT supports manufacturers transitioning from synthetic dyes with its plant-based Exberry color range made from non-GMO fruits, vegetables, and plants. It is expanding its Exberry Organics range with a new bright pink liquid concentrate made from purple sweet potatoes, certified organic for the US and EU markets.

This month, California introduced a pioneering law to eliminate ultra-processed foods (UPFs) from public school meals — the first US state to enact such measures. The Environmental Working Group says food will be considered UPF if it’s high in saturated fat, added sugar, or sodium, and contains a food additive like artificial colors. Walmart commits to removing artificial colorings from its private brand products, prioritizing cleaner, safer ingredients for healthier consumer choices.

Walmart commits to removing artificial colorings from its private brand products, prioritizing cleaner, safer ingredients for healthier consumer choices.