- Industry news

Industry news

- Category news

Category news

- Reports

- Key trends

- Multimedia

- Journal

- Events

- Suppliers

- Home

- Industry news

Industry news

- Category news

Category news

- Reports

- Key trends

- Multimedia

- Events

- Suppliers

Colors in focus: Experts consider natural food dye challenges amid looming FDA deadline

Key takeaways

- The transition from synthetic to natural food dyes is being driven by both consumer demand and regulatory pressure.

- F&B companies face sourcing, supply chain, and manufacturing hurdles, including taxes, shortages, and variability in natural dyes.

- Manufacturers must use technology, scenario planning, and clear consumer communication to ensure consistency, compliance, and brand loyalty during the shift.

Sourcing natural dyes amid escalating global tariffs presents a multifaceted challenge for F&B manufacturers. They are gravitating toward natural colors typically sourced from specific regions with favorable climates and traditional expertise, but when these regions are subject to reciprocal tariffs, the cost of importing such materials can rise steeply.

As a result, the shift to natural dyes introduces significant economic and logistical hurdles in a “globally fragmented” trade environment, according to US-based Logility, an AI-driven supply chain planning platform, which provides food-specific compliance solutions to companies.

As the US FDA’s deadline for transitioning to natural colors looms, companies that are proactive with the shift are expected to lower long-term operational risk, align with shifting consumer preferences, and capture market share from slower-moving competitors.

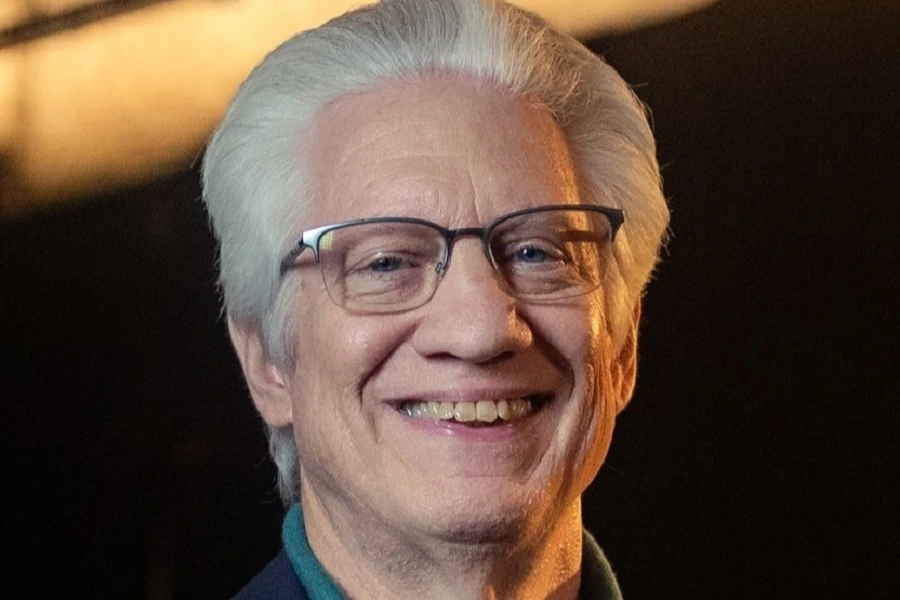

Food Ingredients First speaks with Jack Payne, VP for product management & solutions consulting for Logility’s sister company Aptean, and Joe Slater, business consultant for Logility, to understand how F&B firms can navigate the synthetic to natural dye shift. They unwrap the hurdles related to sourcing and consumer communication, and how technologies like digital twins ensure consistency and compliance during the transition.

How do you assess the industry’s shift to natural food colors in response to regulatory changes?

Payne: First, it’s important to recognize that this shift isn’t just a response to new regulatory requirements. It’s driven by consumer demand for greater ingredient transparency and healthier products. One consumer survey found that 79% of respondents at least “somewhat” support the FDA’s plan to phase out artificial dyes. In the same way that consumers drove debates about sugar and artificial sweeteners, public sentiment is shifting in favor of natural alternatives to artificial dyes.

The regulatory shift is an “equalizing event” where prepared and flexible companies will flourish, says Payne.This regulatory shift is an equalizing event — everyone is required to participate, and companies that are agile and prepared to meet this demand are best positioned to flourish.

The regulatory shift is an “equalizing event” where prepared and flexible companies will flourish, says Payne.This regulatory shift is an equalizing event — everyone is required to participate, and companies that are agile and prepared to meet this demand are best positioned to flourish.

Right now, companies are reacting in one of two ways. Some are waiting for the new requirements to take effect before making product changes. Others are taking a proactive approach, developing new formulations, testing shipping, handling, and storage methodologies, and educating consumers on the changes.

What are F&B companies’ biggest challenges when transitioning from synthetic to natural food dyes?

Slater: The primary challenge is sourcing a sufficient and reliable supply, as everyone in the industry will compete for the same raw materials. This is expected to cause shortages, and the situation is further complicated by the fact that some colors are simply more challenging to source naturally than others.

Global tariffs could make this scarcity even more challenging to navigate. If regions that supply natural dyes are subject to tariffs, import costs can rise sharply, inflating production expenses and disrupting supply chain reliability.

Payne: To ensure ingredient availability and control costs, companies may need to seek alternative suppliers or partner with multiple suppliers across many countries to maintain their previous volume.

What impact will this regulatory shift have on manufacturing processes, and what steps should companies take to prepare?

Slater: Manufacturers will need to adjust their inventory management processes, storage methods, and scheduling practices. For example, to prevent cross-contamination and the introduction of new allergens from natural dye sources, plants must implement more rigorous cleaning protocols and adjust their scheduling.

Food manufacturers producing for markets with and without dye restrictions can schedule longer production runs of dye-free products, followed by consolidated runs of products that still use artificial dyes. This approach can help maximize revenue, as the margins are often better on products with artificial dyes.

How can food manufacturers ensure product consistency while dealing with the variability in natural dyes?

Payne: Product consistency matters, but reformulated products don’t need to be identical to the original for consumers to love them. Consumers can and will adapt, especially if marketing and messaging effectively guide them through the transition.

The main challenge lies in securing reliable supplies as all companies compete for the same materials, says Slater.From an operational standpoint, food manufacturers should be sure to avoid dependency on any single colorant when reformulating recipes.

The main challenge lies in securing reliable supplies as all companies compete for the same materials, says Slater.From an operational standpoint, food manufacturers should be sure to avoid dependency on any single colorant when reformulating recipes.

To achieve this, manufacturers should work closely with suppliers to understand the properties of new natural ingredients and adjust their manufacturing processes accordingly, ensuring ingredient diversity so that availability doesn’t become a bottleneck when bringing their product to market.

What are the key risks in managing inventory when switching to natural dyes, and how can companies mitigate them?

Slater: The primary risk is a shorter product shelf life. This reality forces a significant adjustment in inventory and logistics planning. This requires a strategic re-evaluation of inventory management, including how and where inventory is held and replenishment frequency.

Brands may need to increase their use of refrigerated storage, which adds cost.

A key strategic adjustment is reconsidering where and in what form the network inventory is held. For instance, companies can strategically delay the final processing steps when the shelf life clock officially begins ticking, holding inventory as semi-finished goods for longer to maximize freshness upon final production.

How should companies adjust their supply chain strategies to deal with the increased costs and supply disruptions from natural dye sourcing?

Payne: Companies can leverage their experience with previous disruptions to inform their strategy. At the same time, having the right systems in place to perform scenario planning, which allows them to track and make adjustments based on potential price and supply constraints, can help anticipate and solve problems before they impact the bottom line.

Slater: Technology like digital twins can help businesses determine if they need to redesign their network or adjust sourcing strategies to remain efficient. Fundamentally, companies must prepare to seek alternative suppliers or partner with multiple suppliers to ensure a steady volume of ingredients.

How important is consumer sentiment in driving the shift to natural food dyes, and how should companies communicate this change?

Slater: Consumer sentiment is a primary driver of this shift. The transition will be as much a marketing and messaging operation as it is a logistical one. Planning now to communicate transparently through packaging and marketing will help brands build trust and highlight the positive transition.

Consumer opinion is driving the natural dye shift, making clear communication as important as logistics.Payne: Start educating consumers now. Brands must educate consumers on the changes made, the rationale for making them, and, most importantly, how they will impact the consumer experience. When brands get ahead of regulatory requirements and consumer sentiment, they achieve credibility and consumer loyalty. We’ve seen this before with other dietary changes, like introducing products high in fiber or low in sodium.

Consumer opinion is driving the natural dye shift, making clear communication as important as logistics.Payne: Start educating consumers now. Brands must educate consumers on the changes made, the rationale for making them, and, most importantly, how they will impact the consumer experience. When brands get ahead of regulatory requirements and consumer sentiment, they achieve credibility and consumer loyalty. We’ve seen this before with other dietary changes, like introducing products high in fiber or low in sodium.

Looking ahead, how can F&B companies position themselves as leaders in the shift to natural food colors?

Payne: Artificial coloring won’t be the last shift in regulatory standards or consumer preferences. The secret to long-term success is anticipating changes and pivoting proactively. In this case, leaders will be the companies that investigate, plan, and act now. This means beginning to reformulate products and source new supply streams for natural dyes immediately.

The right technology can help, but it takes resolve, resilience, and planning to stay ahead of the curve consistently. Those who can achieve this will build even deeper loyalty with their customers in the long run.